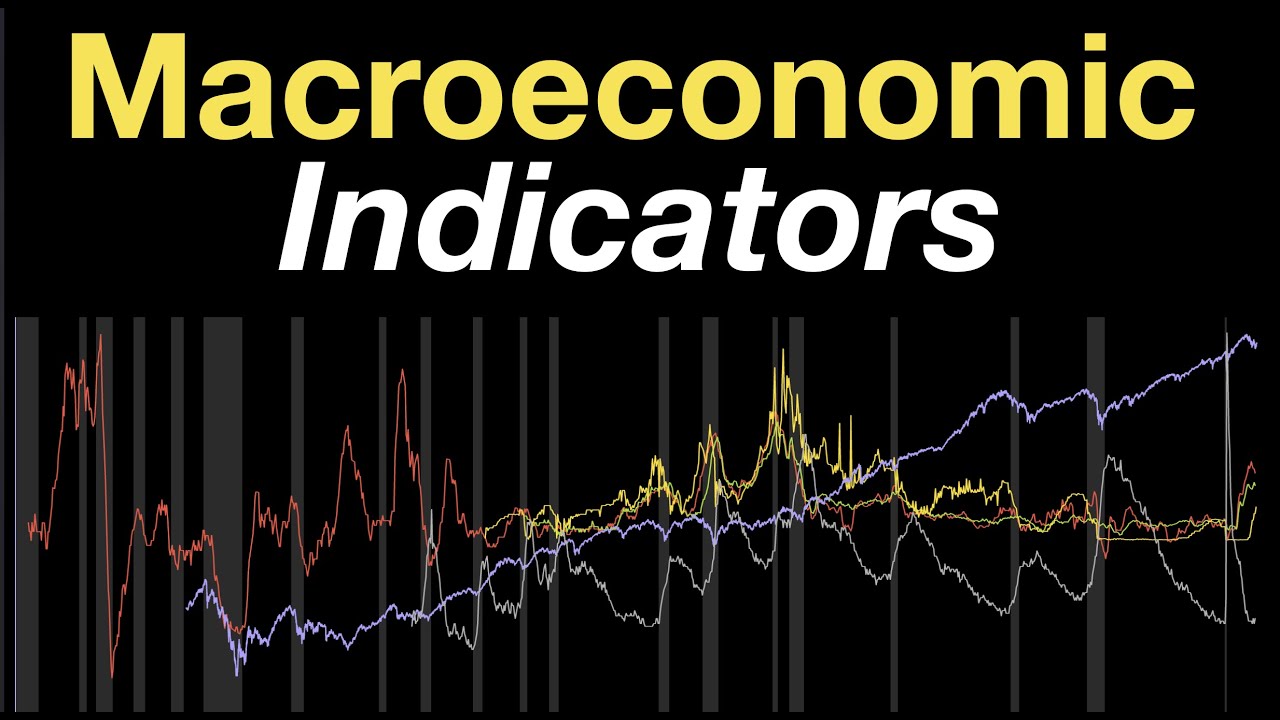

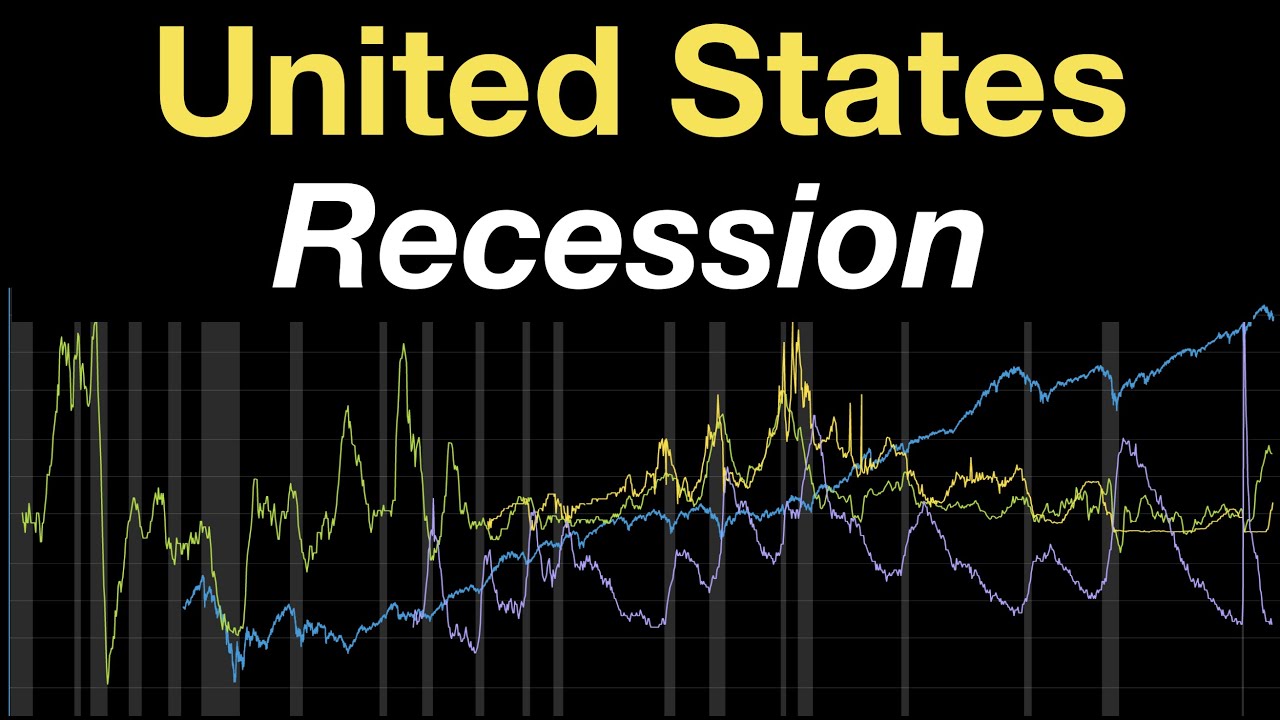

The CPI consists of eight major components, each representing a different category of consumer spending. Each of these categories is assigned a weight by the Bureau of Labor Statistics (BLS) based on its importance to the average consumer’s spending habits. This weight determines how much each category contributes to the commonly known headline inflation. The eight components with their weights as of February 2023 are:

Food and Beverages (14.3%): the cost of food items such as meat, poultry, fish, eggs, dairy products, fruits, and vegetables, as well as non-alcoholic beverages.

Housing (44.4%): The cost of renting or owning a home, including rent, mortgage payments, and property taxes.

Apparel (2.6%): The cost of clothing and footwear for men, women, and children.

Transportation (16.8%): The cost of purchasing and maintaining a vehicle, as well as the cost of public transportation, such as buses, trains, and airplanes.

Medical care (8.0%): The cost of medical services, prescription drugs, and health insurance premiums.

Recreation (5.4%): The cost of entertainment, such as movie tickets, sporting events, and recreational equipment.

Education and communication (5.8%): The cost of tuition, books, and supplies for education, as well as communication services, such as telephone and internet.

Other goods and services (2.7%): This category includes a wide range of goods and services, including personal care products, household goods, and services such as legal and financial advice.

Into The Cryptoverse Premium SALE:

https://intothecryptoverse.com

Into The Cryptoverse Newsletter:

https://newsletter.intothecryptoverse.com/

LIFETIME OPTION:

https://intothecryptoverse.com/product/subscription-to-the-premium-list-lifetime/

Alternative Option:

https://www.patreon.com/intothecryptoverse

Merch:

https://store.intothecryptoverse.com/

Disclaimer: The information presented within this video is NOT financial advice.

Telegram: https://t.me/intocryptoverse

Twitter: https://twitter.com/intocryptoverse

TikTok: tiktok.com/@benjamincowencrypto

Instagram: https://www.instagram.com/bjcowen/

Discord: https://discord.gg/UGwc6eR

Facebook: https://www.facebook.com/groups/intothecryptoverse

Reddit: https://www.reddit.com/r/intothecryptoverse/

Website: https://intothecryptoverse.com/

source